extended child tax credit calculator

First its value was boosted to a 3000 maximum for children aged 6 to 17 and a 3600 maximum for children under the age of 6. Get your advance payments total and number of qualifying children in your online account.

Child Tax Credit Update How Will Ctc Affect Your 2022 Tax Returns Marca

You will need to have certain information on hand before you begin working with the hmrc child credit calculator but once you begin it is fairly easy and only takes ten or fifteen minutes to.

. Enter your information on Schedule 8812 Form 1040. The Child Tax Credit provides money to support American families. The first one applies to the extra credit amount added to.

How much will I receive per child. Our child tax credit calculator will help you estimate your refundable child tax credit. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

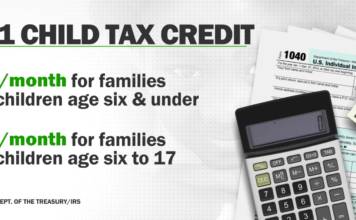

Child age 5 and younger Max credit of 3600 each Child age 6-17 Max credit of 3000 each Phase-out The maximum value of the tax credit reduces by 50 for every 1000 in income above the. The boosted Child Tax Credit was also made fully refundable and. Tax Changes and Key Amounts for the 2022 Tax Year.

Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000 over certain income limits see the FAQs below. Stock photo of calculator. Child Tax Credit Calculator for US Expats Use this handy expat tax calculator to estimate your refundable child tax credits.

Complete IRS Tax Forms Online or Print Government Tax Documents. Congress also expanded the child tax credit temporarily from 2000 to 3600 for young children and 3000 for school-age children and then delivered half of it in monthly payments during the second half of 2021 rather than making families wait until they filed their taxes to claim the full amount. According to the IRS.

Start Child Tax Credit Calculator Dont get TurboCharged or TurboTaxed. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. Distributing families eligible credit through monthly checks for.

Enter your information in the calculator to see how you compare to these three families. Here is some important information to understand about this years Child Tax Credit. The American Rescue Act of 2021 temporarily increases the Child Tax Credit up to 3600 per child under age six and up to 3000 per child under age 18.

The changes increased the child tax credit from 2000 to 3000 for children over 6 and to 3600 for children under 6. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. 2021 Child Tax Credit Calculator Estimate Your 2021 Child Tax Credit Advance Payments The IRS is no longer issuing these advance payments.

To reconcile advance payments on your 2021 return. The funds are available for children from 6 to 17 years old and cost 41 per month. This tax credit is changed.

Parents with higher incomes also have two phase-out schemes to worry about for 2021. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. CNN Eligible parents will begin receiving the first monthly installment of the new enhanced child tax credit starting on July 15.

The maximum benefit is 3600 per child under 6 and 3000 per child ages. In 2022 US expats are eligible to receive between 1400 up to 3600 per qualifying child on their 2021 US Tax Return. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line.

Our child tax credit calculator factors in this reduction for you. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of.

Child Tax Credit Reduced Usage Of High Cost Financial Services The Source Washington University In St Louis

Child Tax Credit Schedule 8812 H R Block

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

Child Tax Credit Is There A Credit Similar Available In 2022 Fingerlakes1 Com

Try The Child Tax Credit Calculator For 2021 2022

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

September Child Tax Credit Payment How Much Should Your Family Get Cnet

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Tax Credit Definition How To Claim It

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

2021 Child Tax Credit Calculator Internal Revenue Code Simplified

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

September Child Tax Credit Payment How Much Should Your Family Get Cnet

Top Tax Refund Calculators In 2022 To Estimate Irs Payments With New Child Tax Credit

Child Tax Credit 2021 Website To Help You Claim 2nd Half Of Credit Is Live